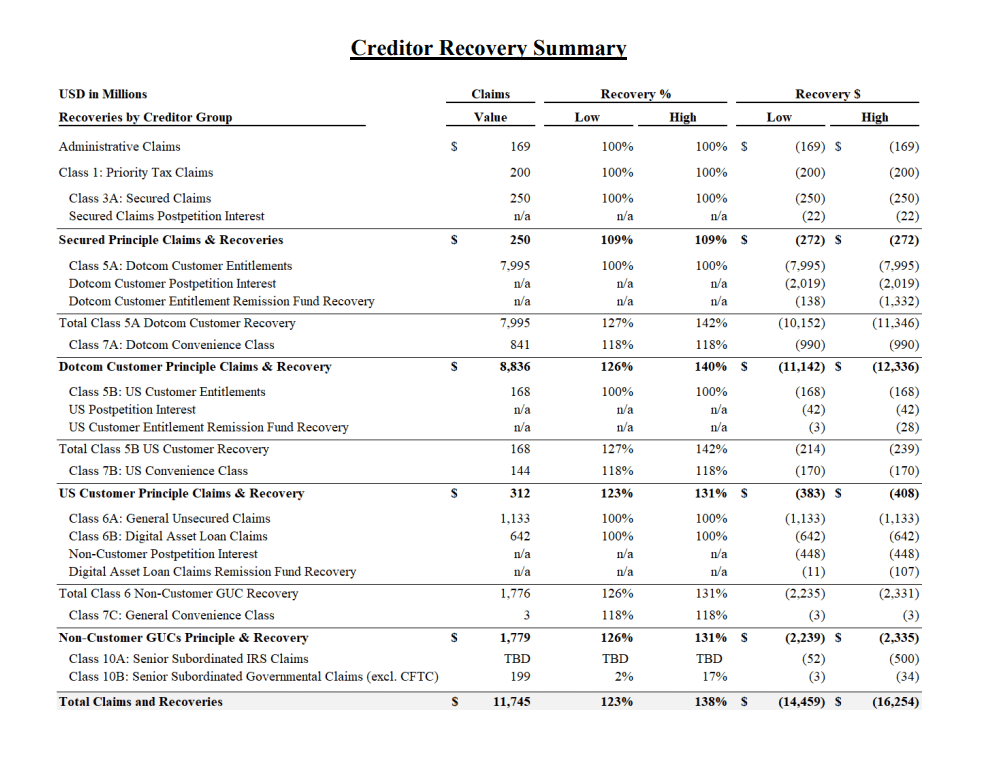

Nearly two years after the seismic collapse of FTX, the U.S. Bankruptcy Court has confirmed its Plan of Reorganization, marking a historic milestone in one of the most complex financial recoveries in modern history. With over $14.7 billion in recovered assets—potentially climbing to $16.5 billion— the FTX Bankruptcy Plan is not only addressing its massive financial shortfall but is also setting an unprecedented example of restructuring within the cryptocurrency world. As the dust settles, the question remains: what does this mean for the future of decentralized finance, and what are the broader implications of FTX’s recovery?

At the heart of this story lies a philosophical question: can broken systems be trusted again after massive failure? FTX’s downfall revealed systemic vulnerabilities in not just its operations, but in the very ethos of unregulated financial markets. For a brief period, FTX was a beacon of the digital finance revolution, promising decentralization, transparency, and efficiency. Yet its rapid implosion exposed the thin line between innovation and deception.

FTX Bankruptcy Plan: A Path Forward

FTX’s recovery plan is ambitious—promising 119% of allowed claims to 98% of creditors, and more importantly, returning 100% of bankruptcy claims plus interest for non-governmental creditors. To the average observer, this sounds like a redemption arc. But we must consider the deeper implications of a recovery effort that relies on an extensive, global collaboration between governments, private entities, and regulatory bodies. Is this truly a testament to the resilience of decentralized finance, or does it highlight the increasing need for centralized control to maintain order in a chaotic system?

The process FTX is undergoing—while undeniably monumental—calls into question whether such centralized interventions will become the norm. While the company has partnered with specialized agents across 200 jurisdictions to ensure funds are safely and swiftly distributed, it demonstrates that even the giants of decentralized finance cannot escape the overarching need for coordinated oversight.

Rebuilding Trust: A Realistic Expectation?

John J. Ray III, FTX’s Chief Executive Officer and Chief Restructuring Officer, emphasizes the “tireless work” of the professionals who have recovered billions by “rebuilding FTX’s books from the ground up.” Yet the real test lies in whether the global financial community will ever truly trust FTX—and by extension, similar entities—again.

This is more than a logistical or financial challenge; it is an existential question about trust in technology, and in our own systems. FTX’s plan may return creditors their money, but can it restore the lost faith in decentralized platforms? The answer will likely set a precedent for how future financial disasters are handled in this space.

The Bigger Picture: Lessons from FTX’s Fall

Perhaps the most striking element of FTX’s reorganization isn’t its financial recovery but the moral and ethical questions it forces us to confront. In a world where technology has outpaced regulation, the story of FTX reminds us that unchecked innovation can lead to catastrophic failures. However, the court’s confirmation of the Plan is not just about financial closure; it is a reflection of how human institutions—governments, regulatory bodies, and financial advisors—intervene to right the wrongs of failed systems.

Moving forward, FTX’s recovery journey prompts a reevaluation of decentralized finance’s place within the broader financial ecosystem. While it offers the promise of freedom from traditional financial gatekeepers, the FTX saga demonstrates that without trust, freedom can easily spiral into chaos.

Will FTX’s eventual payout to its creditors restore confidence in decentralized finance, or will it serve as a cautionary tale about the limits of trust in technology-driven systems? Time will tell, but FTX’s case serves as a vivid reminder that while systems may fail, the human need for oversight, trust, and accountability remains constant.

This journey is not just about the recovery of billions in assets—it is about the recovery of belief in the future of finance.